Public School Taxes 101

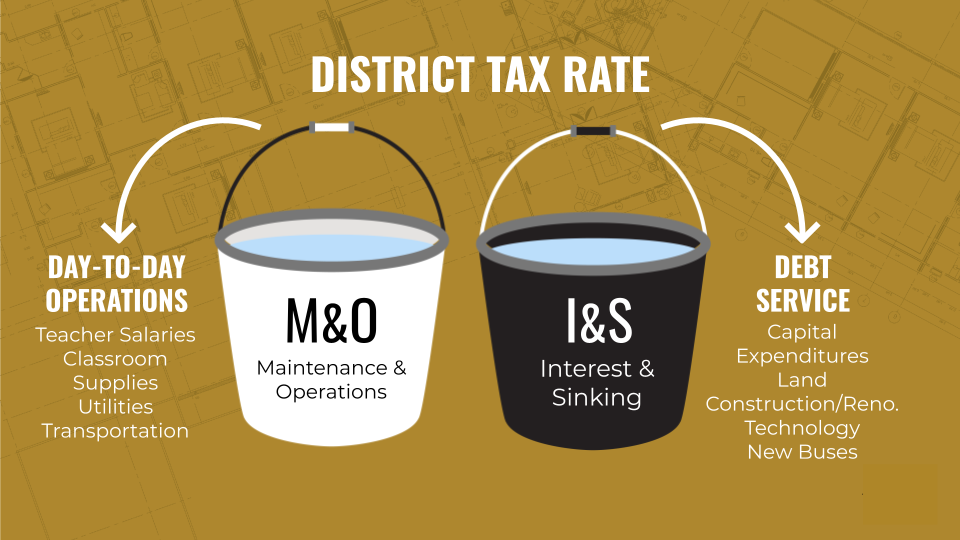

Public school taxes involve two figures, which divide the school district budget into two “buckets.” The first bucket is the Maintenance and Operations budget (M&O), which funds daily costs and recurring or consumable expenditures such as teacher and staff salaries, supplies, food and utilities. Most of the district’s M&O budget goes to teacher and staff salaries.

Public school taxes involve two figures, which divide the school district budget into two “buckets.” The first bucket is the Maintenance and Operations budget (M&O), which funds daily costs and recurring or consumable expenditures such as teacher and staff salaries, supplies, food and utilities. Most of the district’s M&O budget goes to teacher and staff salaries.

The second bucket is the Interest and Sinking Fund (I&S), also known as Debt Service, and that is used to repay debt for capital improvements approved by voters through bond elections.

Proceeds from a bond issue can be used for the construction and renovation of facilities, the acquisition of land and the purchase of capital items such as equipment, technology and transportation. By law, I&S funds cannot be used to pay M&O expenses, which means that voter-approved bonds cannot be used to increase teacher salaries or pay rising costs for utilities and services.